ATTORNEY GENERAL LOSES EMERALD CAY STAMP DUTY RECOVERY CASE AT PRIVY COUNCIL

By Hayden Boyce – Publisher & Editor-in-Chief,on 15th of March 2013

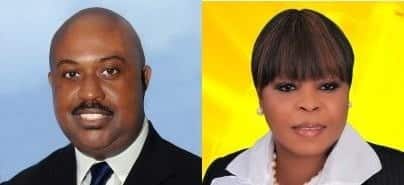

Prominent Turks and Caicos Islands Queen’s Counsel Ariel Misick secured a stunning victory at the Judicial Committee of the Privy Council (JCPC) on Wednesday March 14th, 2013, when British law Lords dismissed an appeal that was brought by Attorney General Huw Shepheard, the Civil Recovery Unit and the Registrar of Lands over the recovery of unpaid stamp duty and penalties in relation to sale of the private island of Emerald Cay.

In the case which was heard before Lord Hope, Lord Kerr, Lord Reed, Lord Carnwath and Sir John Chadwick who delivered the judgment, the Privy Council found that the Registrar of Lands operated outside of the law in dealing with the stamp duty issue surrounding Emerald Cay, once owned by American billionaire Tim Blixseth and which is located off Silly Creek and Chalk Sound, on the island of Providenciales.

Queen’s Counsel Misick, who was instructed by Sharpe Pritchard, was the lawyer for Ross Richardson, the Trustee in Bankruptcy of Yellowstone Club World, a company owned by Blixseth and which had interests in Emerald Cay. Lawyers for the Interim Government were Queen’s Counsel David Phillip and Patrick Patterson, instructed by Edward, Wildman and Palmer of the Civil Recovery Unit.

On March 12, 2011 the Attorney General, on behalf of the then Interim Government, commenced proceedings against (amongst others) Emerald Cay Ltd for recovery of unpaid stamp duty and penalties. The Government obtained judgment in those proceedings on June 21, 2011, then the case went before Mr. Justice Martin on June 7th 2011.

By an order made on June 9th, 2011 Judge Martin ordered that the Registrar of Lands remove the restriction and register the charge. The Emerald Cay owners appealed that order and it went before the Court of Appeal comprising Justices Edward Zacca, Elliott Mottley and Richard Ground who dismissed the appeal on January 26 2012 and affirmed the order of the Supreme Court.

The issue raised by the appeal before the Privy Council was whether the Registrar was wrong to register a restriction, under section 132 of the Registered Land Ordinance, against property in respect of which the Government claimed an interest in respect of unpaid stamp duty.

According to the 19-page judgment, it was submitted on behalf of the Attorney General, that it was immaterial that the Government may have been wrong to assert, in its application for the entry of a restriction, that it had an interest in the land comprised in title 60400/219.

The judgment stated: “The relevant questions were (1) the extent of the Registrar’s power to register a restriction and (2) whether, on the facts known to her, it was lawful for her to have exercised that power. In relation to the first of those questions the appellants rely exclusively on section 132(1) of the Registered Land Ordinance: it is not said that this is a case in which section 132(3) has any application. It is accepted that the power conferred by section 132(1) is discretionary: “…the Registrar may… make an order … prohibiting or restricting dealings with any particular land …” (emphasis added). But it is pointed out that the discretionary power may be exercised “for any … sufficient cause”; and that it may be exercised by the Registrar of her own motion: “… without the application of any person interested in the land …”. Those propositions are not in dispute. But, on the facts as presented (and, in particular, in the absence of any evidence from the Registrar herself), it is impossible to avoid the conclusion that, in this case, the Registrar did not exercise the power conferred by section 132(1) of her own motion: she exercised that power on the basis of the application that was made on behalf of the Government.”

The judges added: “ In exercising the power on the basis of the application that was made on behalf of the Government – and in making Entry No 5 on the register – the Registrar must be taken to have accepted that the Government was entitled, by virtue of the interest in the land which it claimed, to prohibit any dealing with the land comprised in title 60400/219. The Board (judges of the Privy Council) can see no escape from the conclusion that the Registrar did not, in fact, ask herself whether there was any sufficient cause – other than the claim made on behalf of the Government – which should lead her to enter a restriction.

“In reaching that conclusion the Board rejects the submission, made on behalf of the appellants, that the restriction entered comprises two distinct limbs: (A) a statement that “The Government of the Turks and Caicos Islands claims an interest under the Stamp Duty Ordinance in whole of the above-mentioned parcel as more fully set forth in the Application to Enter a Restriction dated 19 May 2010” and (B) an order, made under section 132(1) of the Ordinance, by which the Registrar “prohibits any dealing with the parcel until the full amount of stamp Duty on the sale of the parcel from Worldwide Commercial properties Ltd to Emerald Cay Ltd on 14 August 2006 has been duly paid”.

“It is plain that the subject of the verb “prohibits” is “The Government of the Turks and Caicos Islands”: the restriction cannot be read in the sense that it is the Registrar who is the subject of that verb. And, given that the text of the restriction follows, without material variation, the text of the restriction applied for in the Government’s application dated 4 June 2010, that is unsurprising.”

The judgment continued: “ If the Registrar did not, in fact, ask herself whether there was sufficient cause – other than the claim made on behalf of the Government – which should lead her to enter a restriction, then her decision to do so was flawed in law. For the reasons that Mr. Justice Martin and the Court of Appeal have given, there was no basis for the Government’s claim that it was entitled to an interest in the land comprised in title 60400/219; and no basis upon which the Government was entitled to prohibit dealings with that land until the full amount of the stamp duty payable on the transfer from Worldwide Commercial Properties Ltd to Emerald Cay Ltd had been made.

“It was submitted on behalf of the Attorney General that the fact that the Registrar’s decision to enter a restriction was reached on a flawed basis is not fatal to the validity of the restriction. It is said that, on the material which was before her, the Registrar could properly have reached a decision to enter a restriction without relying on the Government’s claim to an interest in the land: “. . . what matters is whether the material in the Registrar’s possession justified the exercise of the power. If it did, the power will have been exercised lawfully”.

Emerald Cay was acquired on August 14 2006 by Emerald Cay Ltd a company incorporated in the Turks and Caicos Islands of which Mr. Timothy Blixseth was the ultimate beneficial owner.

The purchase price paid by Emerald Cay Ltd was US $28million, but that the acquisition was structured through a series of agreements in such a way that the consideration stated in the transfer to Emerald Cay Ltd – and on which stamp duty was paid – was US $10million.

Yellowstone Club World LLC, another company of which Mr. Blixseth was the ultimate beneficial owner, was party to one of those agreements. On August 17 2006 Emerald Cay Ltd was registered as the proprietor of the property.

On February 18 2009 Mr. Richardson was appointed by the United States Bankruptcy Court for the District of Montana to be the Trustee of the Estate of Yellowstone Club World LLC.

On March 5th 2009, as Trustee, he lodged a caution with the Registrar of Lands, pursuant to section 127 of the Registered Land Ordinance, forbidding the registration of dispositions and the making of entries in respect of the property (Emerald Cay) registered under title number 60400/219 without his consent.

The caution was registered by the Registrar on March 25th 2009.

On November 24 2009 the Trustee commenced proceedings against Mr. Blixseth in the United States. The claims made in those proceedings included claims in respect of the Emerald Cay property. The Trustee and Mr. Blixseth reached a settlement in respect of those claims; and, on 10 June 2010 the United States Bankruptcy Court approved the terms of that settlement.

On 13 August2010 Emerald Cay Ltd executed a collateral charge over the property for the purpose of securing payment of US $9.6million under the settlement. On 16September 2010 the Trustee applied to the Registrar for withdrawal of the caution and registration of the charge.

In the meantime, on 4 June 2010, the Government of the Turks and Caicos Islands, having become aware of the underpayment of stamp duty due on the transfer of the Emerald Cay property to Emerald Cay Ltd in August 2006, applied to the Registrar for a restriction to be entered, pursuant to section 132 of the Registered Land Ordinance, prohibiting dealings with the property until the full amount of the stamp duty had been paid.

That application was made without notice to the Trustee. The Registrar ordered the restriction sought; and it was entered on the same day (4 June 2010).

On 12 October 2010 the Land Registry informed the Trustee that, pursuant to his application of 16 September 2010, his caution had been withdrawn; but that, by reason of the restriction which had been entered on 4 June 2010, the charge could not be registered.

On 12 March 2011 the Attorney General, on behalf of the Government, commenced proceedings against (amongst others) Emerald Cay Ltd for recovery of unpaid stamp duty and penalties. The Government obtained judgment in those proceedings on 21 June 2011.

On 27 April 2011 the Trustee commenced proceedings before the Privy Council seeking removal of the restriction and registration of the charge.